> Let Us Introduce Ourselves

Today, Hikaru, a tax staff member of mine, is going to make sense of the chaos of your filing obligations for National and Local Individual Income Tax.

I am here to add some extra useful information for you.

Hello, I am Hikaru, an apprentice of Yoshiko’s. What is hard to understand is that he did not have to pay any tax due to these tax returns for 2017. However, in spite of the fact that he had no income at all in 2018, and, thus, no filing obligation for either National or Local Individual Income Tax returns in 2018, he had to pay some Local Individual Income Tax in 2018.

A friend of mine, Akira, did not have to file a National Individual Income Tax return in 2017 but had to file a Local Individual Income Tax return for 2017.

We will figure out the reason with Yoshiko, today.

As Yoshiko said, the series of tax things I faced was chaotic for me. I am so glad that Yoshiko and Hikaru are going to explain what happened to my incomes and taxes in 2017 and 2018. Besides, Yoshiko said that I am likely able to apply for a refund of my Local Individual Income Tax which I paid in 2018 because it seems a fine line whether or not I had to pay Local Individual Income Tax in 2018. I want to know if I really can.

目次

- 1 I. National Individual Income Tax Filing Obligation

- 2 II. Local Individual Income Tax or Inhabitant Tax Filing Obligation. (Metropolitan Tax, Ward Tax, Prefectural Tax and Municipal Tax, etc.)

- 3 III. Filing Volanteer National Individual Income Tax Return.

I. National Individual Income Tax Filing Obligation

1) Who has to file National Individual Income Tax Return.

If your Gross Taxable Income (hereafter “GTI”), 合計所得金額 pronounced “Goukei-Shotoku-Kingaku” (hereafter “GSK“) exceeds 380,000 yen, you must file your income tax return to a National Tax Office, 税務署 pronounced “Zeimu-Sho” (hereafter “ZMS”)

ZMS is a subordinate organization of the National Tax Agency of Japan (hereafter NTA) and set up more than 500 locations all over Japan.

Please be aware that you can only submit your STZ return to your 所轄税務署 pronounced “SHOKATU-ZEIMU-SHO” (hereafter SZMS). SZMS is a ZMS which has jurisdiction over your residential district. You cannot submit any forms including tax returns to the NTA directly.

2) Where You Find Your Gross Taxable Income.

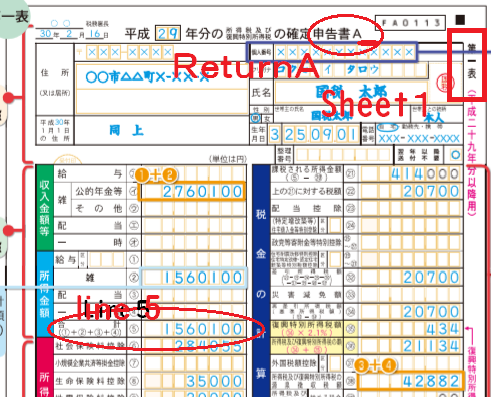

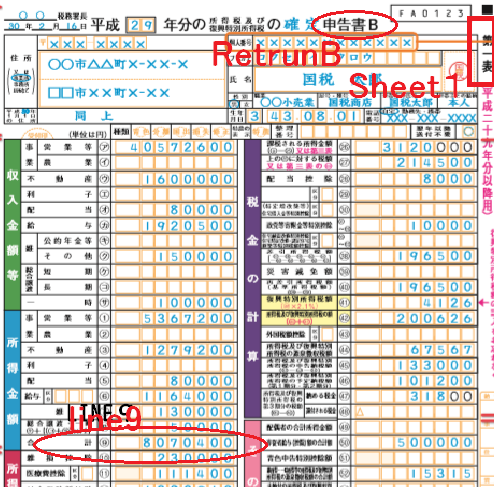

*You can find if your return is Return A or Return B on the top of your return.

(pic 1) Gross Taxable Income GTI, 合計所得金額 GSK in Japanese, on sheet 1 of Return A, 所得税確定申告書A

(pic 2) Gross Taxable Income GTI, 合計所得金額 GSK in Japanese, on sheet 1 of Return B, 所得税確定申告書B

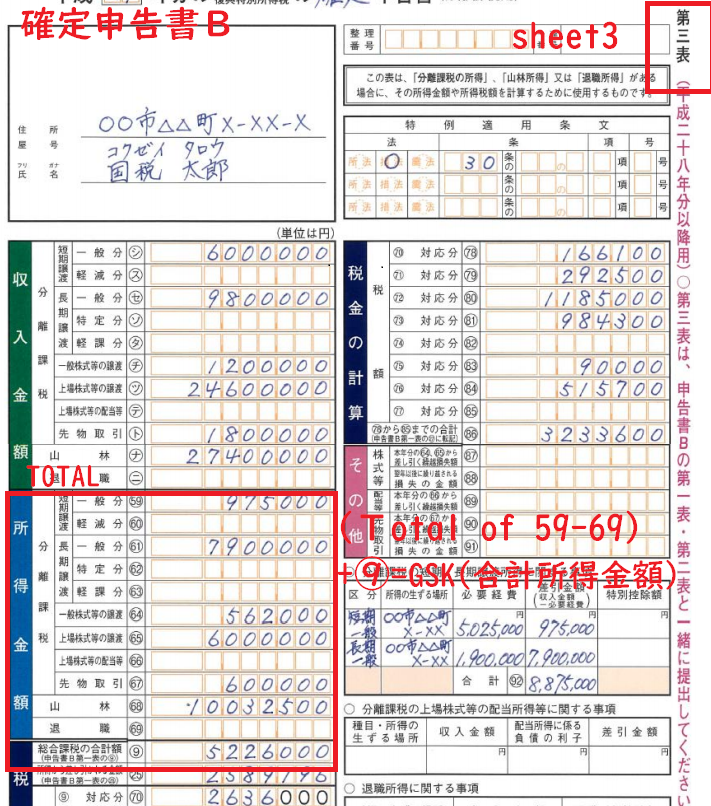

However, the taxpayers who have Separately Taxed Incomes, 分離課税所得 pronounced “BUNRI-KAZEI-SHOTOKU” (hereafter BKS), such as Real Estate Capital Gain, Investment Capital Gain, and etc., have Sheet 3 (第三表)for Return B. In this case, it is the total of the red section highlighted on sheet 3 of Return B (SEE pic 3).

(pic 3) Gross Taxable Income GTI, 合計所得金額 GSK in Japanese, on sheet 3 of Return B

Please note that you should consult a 税理士, CPTA, or ZMS if you are in any of the following situations:

1) having 第四表, Sheet 4 of Return B.

2) having losses in this tax year.

3) applying Aggregation of Profit and Loss Provision, 損益通算 pronounced “Son-Eki-Tuusan” in this tax year.

4) carrying Deferred Taxable Loss, 繰越損失 pronounced “Kurikoshi-Sonshitu” in the recent four tax years including this year.

In these cases, determining GSK is not simple, besides the judgment of whether filing a return or not should be based on which is the most preferable for you, not based on whether or not you have a legal obligation for filing a tax return.

Then, the municipality administers and levies both of your Prefectural Individual Income Tax, 個人県民税 pronounced “KOJIN-KENMIN-ZEI” (hereafter KKZ) and Municipal Individual Income Tax, 個人市民税 pronounced “KOJIN-SHIMIN-ZEI” (hereafter KSZ) based on the copy provided by your SZMS. Depending on which municipality your certificate of residency has been registered in, 個人県民税 can be either 個人道民税 for people living in Hokkai-Do, 個人都民税 for people living in Tokyo-To, or 個人府民税 for people living in Osaka-Fu or Kyoto-Fu. Likewise, 個人市民税 can be either 個人区民税 for people living in the 23 special wards in Tokyo, 個人町民税 for people living in any town, 町 pronounced “MACHI”, or 個人村民税 for people living in any village, 村 pronounced “MURA”. Thus, the municipality will receive your 2018 tax information around April 2019 and will complete the computation of your KJZ based on your 2018 income, then, mail a tax bill to you or your employer if you are a salary earner in June. Commonly, you have to pay your KJZ in four equal installments, due at the end of June, August, October in 2019 and January in 2020, or your employer will deduct your KJZ from your monthly salaries over the period of June 2019 to March 2020. Please be aware that this KJZ paid from June 2019 to 2020 January or March is defined as the KJZ of 2019, despite its tax base is your taxable income in 2018. As some of you might already realize, if you quit your job and have no income after that, it would be better for you to keep a certain fund for your KJZ for the next year. Even if you do not have any income in 2019, you still have to pay the high KJZ in 2019 regardless of your current income because it is computed based on your income in 2018. This tax return transfer system between ZMSs and municipalities does not exist for Corporate Income Tax Returns. So, corporations must file three tax returns, for National Corporate Income Tax, Metropolitan or Prefectural Corporate Income Tax, and Municipal Corporate Income Tax. However, corporations located in the 23 special wards in Tokyo file a return for Metropolitan Corporate Income Tax and Ward Corporate Income Tax for the Tokyo Metropolitan Government Bureau of Taxation, 都税事務所 pronounced “TO-ZEI-JIMUSHO” (hereafter TMGBT). Akira, can you explain your experience in 2017 and 2018? However, I got a notice from the municipal government around May 2018, and they said to me that I should have filed my KJZ Return for 2017 by March 15, 2018, which I did following the municipal officer’s instruction. If it is possible, can you give us your real figures, Akira? Even though I filed my KJZ Return and paid some KJZ following the instruction by a municipal officer, I did not understand the system and have had doubts about the tax procedures all the way up to now. I earned a salary of 1,020,000 yen in 2017 1,020,000 yen – 650,000 yen, which is Salary Income Deduction, “給与所得控除” pronounced “KYUUYO-SHOTOKU-KOUJYO”. The 370,000 yen does not exceed 380,000 yen, which is actually Standard Deduction of 所得税, STZ, thus, you did not have to file an STZ return. Continue to talk about KJZ, please. Your GSK of 370,000 yen exceeds 350,000 yen, thus, you had to file your KJZ return to your municipality. So I recommend, in most cases, contacting municipality to find the exact figure of your Standard Deductions for KJZ per income and per capita. In Akira’s case, the Standard deductions of both KJZ per income and KJZ per capita are 370,000 yen as a single taxpayer. Your Standard Deduction is determined by in which prefecture and municipal district you are living, if you have qualified spouse or dependents, what kinds of incomes you have, and etc. 所得税, STZ Liability: Nil because his GSK does not exceed 380,000 yen. 個人住民税, KJZ per income: (370,000-350,000)*10% (Flat rate)=2,000 yen 個人住民税, KJZ per capita: 5,000 yen (Flat amount) However, your case is the simplest case because you are single and have no family. The KJZ formula is complicating especially when taxpayers have a family. So, when you do not file an STZ return, I recommend you to contact municipalities to find how to treat your KJZ matter. Yoshiko, you mentioned a posibility of applying a 個人住民税, KJZ refund the other day. Please tell us about it. Actually, a Working Student Deduction for KJZ is 260,000 yen which is 10,000 yen less than that of SKZ. So that means Akira could have avoided any KJZ payment in 2018 anyway. 最後までお読み下さり、ありがとうございました。

II. Local Individual Income Tax or Inhabitant Tax Filing Obligation. (Metropolitan Tax, Ward Tax, Prefectural Tax and Municipal Tax, etc.)

1) Tax Return Transfer between National Tax and Inhabitant Tax.

* Certificate of Residency, 住民票 in Japanese pronounced “JYUUMIN-HYOU“

2) Tax Base and Tax Payment Timing for the Individual Inhabitant Income Tax

* Corporate Income Tax

3) Individual Inhabitant Tax Filing Obligation

4) Case Study: Akira’s Case for KJZ in 2018

*Standard Deductions for KJZ

III. Filing Volanteer National Individual Income Tax Return.

1) Reduce Your Gross Taxable Income to Equal or Less than 260,000 yen.

ご質問、事例記事リクエストを受け付けております。お気軽にお問い合わせ下さい。